News

Varo Money secures $45 million from investors

The mobile banking app VaroMoney just closed a $45M Series B led by The Rise Fund (Bono’s investment fund).

Kreditech partners up with Mambu

Kreditech is planning to expand into India in early 2018, utilising Mambu’s SaaS banking engine to power a new short-term lending product tailored to local consumer and regulatory needs.

Chase to fund cars through fintech platform

JPMorgan Chase & Co.’s consumer and commercial banking business will begin funding car loans through the AutoFi platform.

Funding Circle rumoured to be eyeing IPO

The world’s biggest peer-to-peer business lender may soon become the first to float in the UK. A report from Sky News city editor Mark Kleinman has suggested that the platform is currently in the process of lining up investment banking partners to assist in a beauty parade for the end of Q1 this year. According to the article, a possible listing could take place as soon as late autumn.

The Most Valuable Online Lender? The Answer May Surprise You

GreenSky offers a unique type of point of sale financing and has just closed a $200 million round.

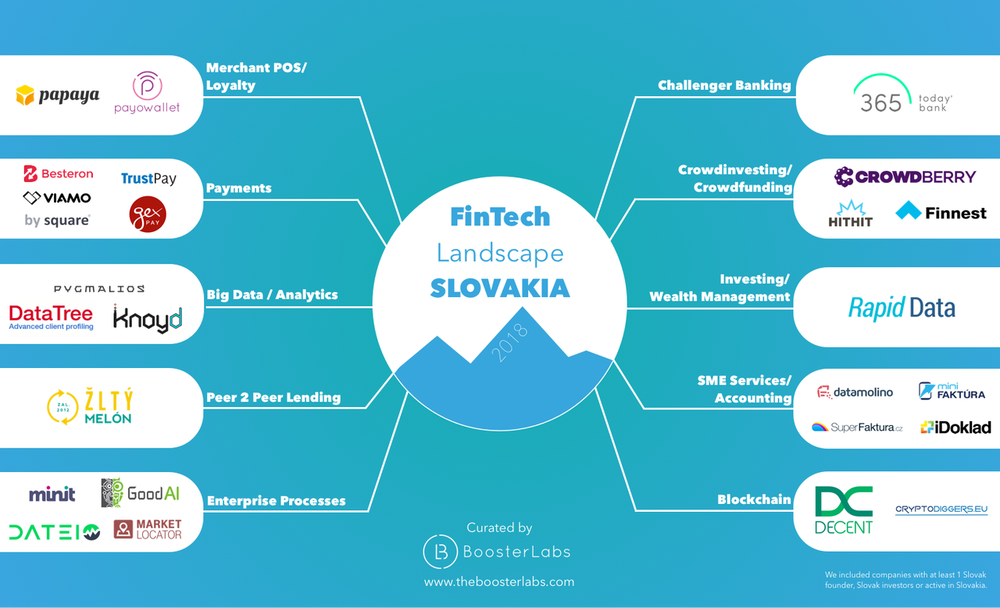

Do You Know FinTech Landscape in Slovakia?

Are you wondering how does the FinTech scene in Slovakia look like? What are the hottest startups and companies growing around us? Žltý melon is one of them.

Brussels moves to boost Europe’s fintech sector

Brussels will propose pan-EU licences to help some fintech companies operate across the bloc, as it fights US and Asian dominance of the burgeoning industry.

Investec and MarketInvoice enter £50m fintech partnership

Invoice finance platform MarketInvoice will power business loans for Investec Asset Finance customers following a £50m commitment from the bank.

Fully-automated fintech lender Billie secures €10m series A

The extent to which the online lending process can be automated is hotly debated in fintech. Perhaps the loudest proponent of full-automation has just scored a significant fundraise.

N26 partners with Younited Credit to launch credit offering in France

German startup N26 is now live in 17 European countries, but many features first launched in Germany and never made their way to other markets. The startup is slowly expanding core features to other key markets. That’s why the company is partnering with Younited Credit to launch consumer credit in France.